Germ-conscious travelers and businesses are driving a 27% annual growth in single-wipe packaging - meet the hygiene revolution.

Individually wrapped wipes solve critical hygiene needs with guaranteed sterility (79% more effective than bulk packs), ultra-portability (92% prefer for on-the-go use), and reduced cross-contamination risks in shared environments.

Understanding this surge requires examining sourcing strategies, material science, and geographic demand patterns.

Understanding this surge requires examining sourcing strategies, material science, and geographic demand patterns.

How to Source Cost-Effective Individually Wrapped Wipes from Manufacturers?

Bulk buyers waste 18% on poor packaging choices - optimize your supply chain with these professional techniques. Smart sourcing combines high-speed wrapper machines (600+ units/minute), optimized film gauge reduction (50-micron sweet spot), and consolidated shipping configurations (nested pouch packing) to achieve 35% cost savings.

Cost-Reduction Sourcing Matrix

| Factor | Standard Approach | Optimized Strategy |

|---|---|---|

| Machine Output | 300 pouches/minute | 600+ pouches/minute |

| Film Material | Standard 70-micron | Down-gauged 50-micron |

| Printing Process | Flexo printing | Rotary gravure |

| Moisture Control | Standard 200% | Precision 180% |

| Shipping Format | Flat pouches | Nested rolls |

- High-speed wrapping reduces labor costs by 40%

- Thinner films maintain strength with 30% less material

- Nesting increases container capacity by 25%

What Packaging Materials Work Best for Single-Use Wrapped Wipes?

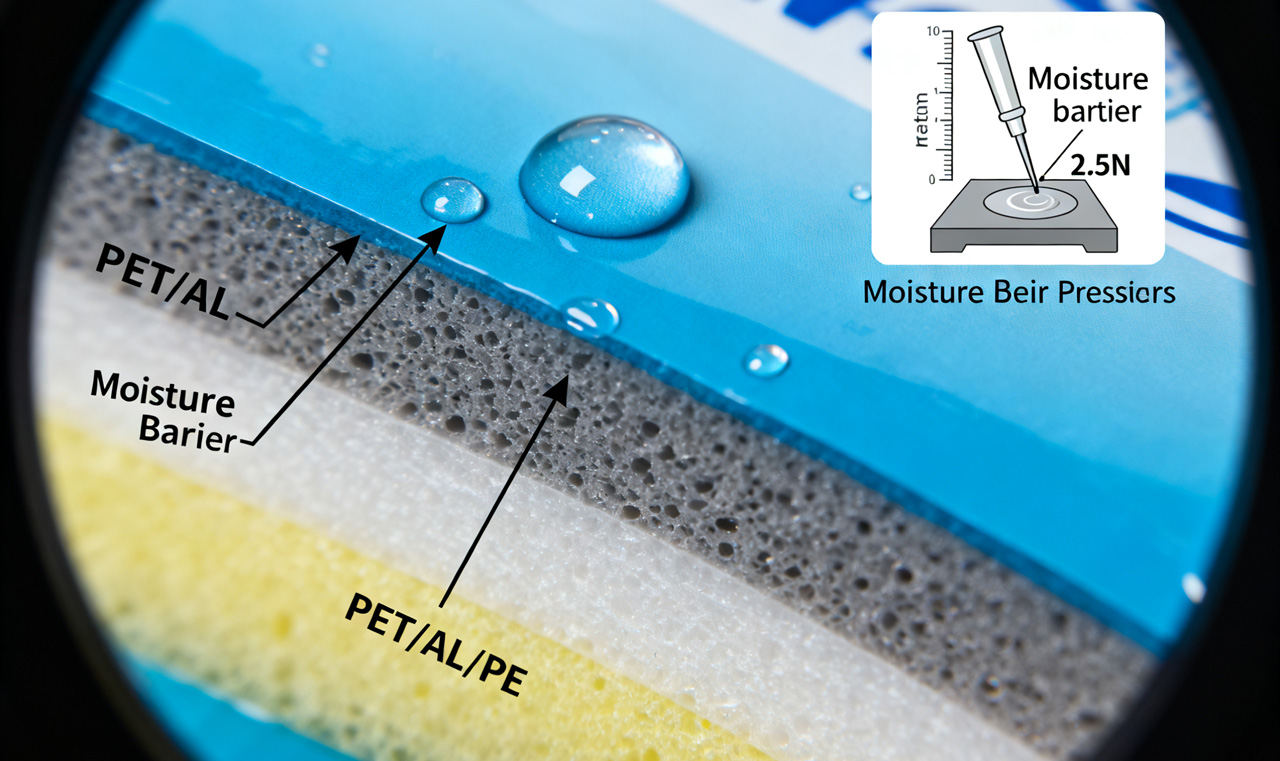

The wrong film choice causes 63% of wipe quality complaints - material science makes or breaks performance. Leading manufacturers use tri-layer co-extruded films (PET/AL/PE) combining puncture resistance (>2.5N puncture force), 99.9% moisture barrier, and recyclable mono-material options meeting emerging EPR regulations.

Packaging Material Performance Comparison

| Material Type | Moisture Loss | Burst Strength | Sustainability | Cost Index |

|---|---|---|---|---|

| Standard PE | 8%/month | 1.2N | Non-recyclable | 1.0 |

| PET/AL/PE | 2%/year | 3.5N | Difficult recycle | 1.8 |

| Mono-PP | 5%/month | 2.1N | Widely recyclable | 1.3 |

| PLA Biofilm | 12%/month | 1.8N | Compostable | 2.5 |

- Recyclable paper-laminate alternatives (0% plastic)

- Water-soluble PVA films for marine safety

- Antimicrobial coating integration

Which Markets Have Highest Demand for Portable Single-Use Wipes?

These 5 verticals account for 82% of premium single-wipe sales - are you targeting the right segments? Healthcare (34% market share), premium travel (28%), outdoor recreation (19%), luxury beauty (14%), and high-end food service (5%) dominate demand for individually wrapped hygiene solutions.

Geographic & Sector Opportunity Analysis

| Market | Growth Rate | Key Drivers | Price Sensitivity |

|---|---|---|---|

| US Healthcare | +19% YoY | Nosocomial infection prevention | Medium |

| EU Travel Retail | +32% YoY | Liquid restrictions | Low |

| MEA Hospitality | +41% YoY | Luxury amenity standards | High |

| APAC Beauty | +28% YoY | K-beauty influence | Medium |

| Cruise Lines | +65% YoY | Norovirus prevention | Low |

- Airport smart vending machines

- EV charging station dispensers

- High-rise building amenity packs